Carbon trading is a hot topic – businesses are crowding into the space looking to develop trading capabilities in the various carbon markets that exist around the world.

There’s a lot of talk about carbon markets, but there are very sharp differences between the types of markets that exist, the kind of companies that can participate and the rules governing trading.

In this article we’ll take a look at compliance carbon markets, which are also referred to as “cap-and-trade” markets.

Firstly, and most importantly, compliance markets are established under national law. They require participating entities (usually companies) to participate by law, and they set stiff financial penalties for failure to comply with any of the regulations.

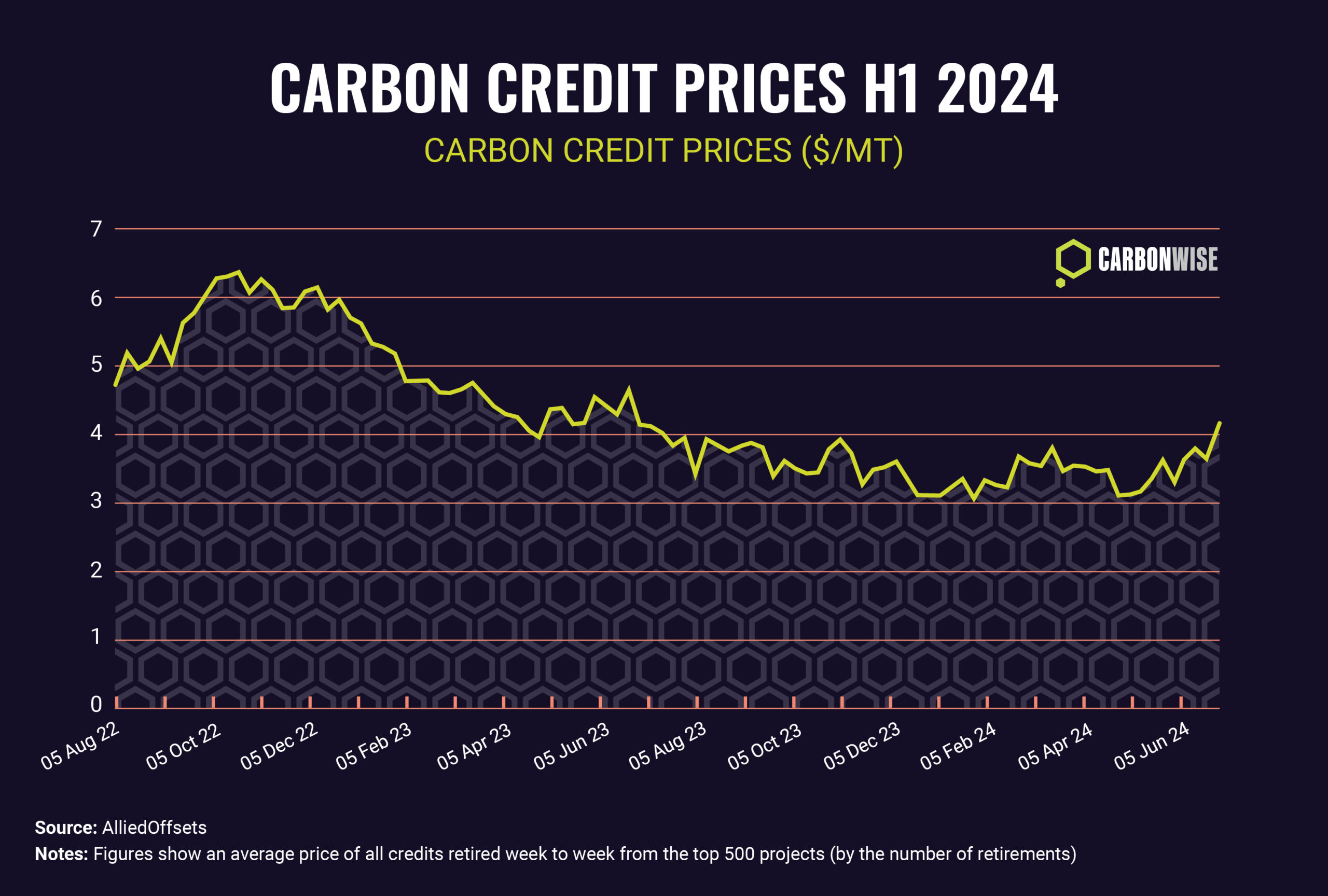

Cap-and-trade markets set a maximum amount of carbon dioxide that can be emitted by all the companies participating in the market system. For example, the European Union’s Emissions Trading System set a cap in 2021 of 1,571,583,007 tonnes of CO2.

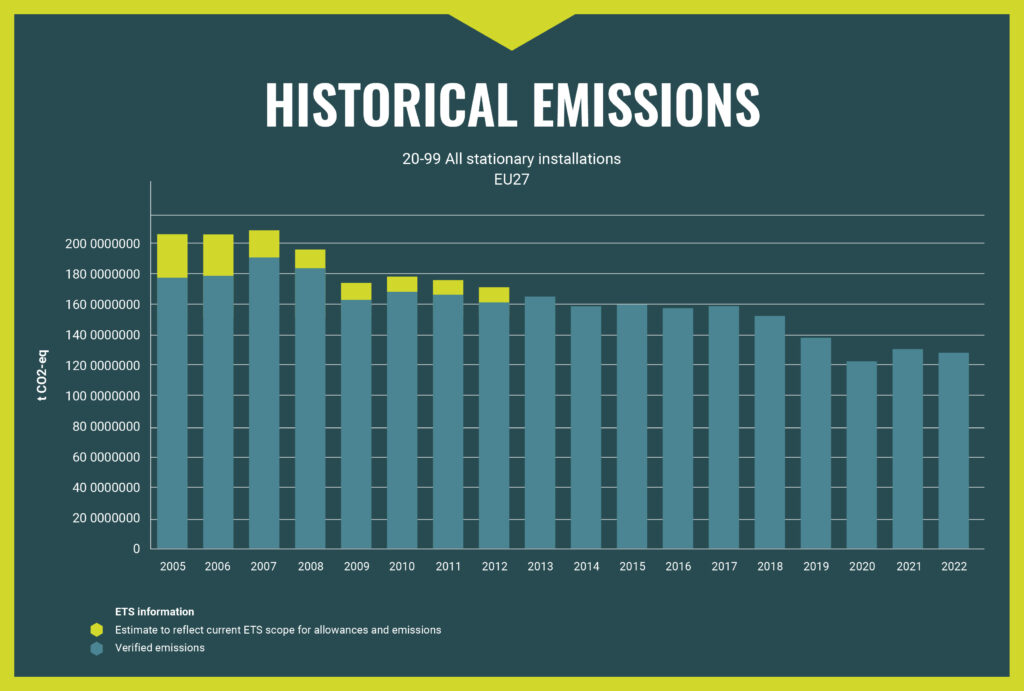

This limit is then expressed as an equivalent number of carbon permits, or allowances, each one representing the legal permission to emit one tonne of CO2 in a specific jurisdiction.

Allowances are created as electronic certificates that are held in a central registry. They are either sold by governments at periodic auctions or handed out free of charge to companies.

These permits are then bought and sold in a regulated marketplace, either in “spot” transactions for immediate transfer, or as “futures” for delivery at a later date.

At the end of each compliance period, regulated companies must measure and verify their emissions for the period, and surrender permits matching that total to the regulator. Surrendered permits are permanently retired.

The key distinguishing element of cap-and-trade is that it is a closed system, with an absolute limit on the number of permits in circulation, and that the annual supply of new allowances shrinks over time to reach a specific emissions goal.

The European Union’s Emissions Trading System, the largest cap-and-trade system in the world, monitors the number of allowances that have been issued and retired and adjusts supply to ensure that there is never a glut of allowances.

Maintaining a steadily tightening supply means that the price of allowances should steadily increase over time, allowing more companies to invest in complex technologies to replace old, carbon-intensive practices.

Source: EU Emissions Trading System annual cap 2005-2022

Cap-and-trade requires companies to account financially for their climate impact – their carbon emissions.

Creating this new cost offers industrial companies the choice between paying for emissions allowances, or investing in cleaner processes and technology that reduce their carbon footprint, and consequently their purchases of carbon permits.

Compliance carbon markets tend to cover heavier, carbon-intensive industries like power generation, cement, fertiliser, chemicals and metals, and can sometimes extend to transportation fuels. Europe is going further by including aviation and maritime shipping in its flagship carbon market.

Other cap-and-trade systems operate in California, Quebec, Washington state, ten northeastern US states (the Regional Greenhouse Gas Initiative), New Zealand, South Korea, the United Kingdom and Switzerland.

Some of these markets cooperate among each other, so that companies in one jurisdiction can buy and surrender permits from another. For example, the California and Quebec markets and the EU and Swiss markets are linked.

Some legally-binding carbon markets exist that don’t use cap-and-trade as their model. For example, China’s emissions trading system sets a limit on carbon intensity – that is, the amount of carbon dioxide emitted per unit of production.

And the international airline industry operates a global offsetting market, the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). This market does not set an overall limit on airline emissions, but it requires that operators offset any emissions over and above a 2019 baseline.