Regulated greenhouse gas emissions in the UK fell sharply in 2023, in line with similar falls across the larger EU carbon market in last year, according to figures released this month. The falls were largely driven by a switch away from fossil fuels for electricity generation to cleaner sources such as wind and solar generation.

Verified emissions regulated by the UK Emissions Trading Scheme (UK ETS) fell by 12.5% in 2023, according to government data released in June. The sharp fall in overall emissions was led by electricity generation, which eclipsed a rise in emissions from aviation for the third straight year.

Emissions under the UK ETS fell to 96.8 million tonnes of CO2 equivalent in 2023, down from 110.6 million tonnes CO2e in 2022, the figures showed.

Within this total, emissions from electricity generation fell by more than 23%, while emissions from heavy industries fell by just under 7%.

Aviation emissions rose by 13% in 2023, bucking the wider trend of falling emissions across the power and heavy industrial sectors.

The UK figures followed the release of similar data for the wider EU Emissions Trading System in April, which showed a 15.5% drop in emissions in 2023. In the case of the EU scheme, emissions are down by a total of 47% since the start of carbon trading in 2005.

The overall trend in the UK and EU data demonstrates a couple of important points: first, carbon markets can be an effective tool, not just in reducing emissions, but also providing enough flexibility to businesses to allow continued economic growth. And second, the latest CO2 figures show that the energy transition continues to power ahead, with clean technology successfully displacing older more emissions-intensive energy generation and industrial processes.

In addition, what can we pick up from the trend in aviation emissions? The continuing rise in emissions from flights should not be a surprise, as the aviation sector’s emissions plummeted in 2020 and 2021 due to COVID-19-related government lockdowns. Emissions from aviation have been rising ever since, as the number of people taking holidays abroad continues to recover.

However, the UK ETS rules should start to bite soon, halting the rise of aviation emissions. That’s because free allowances for aircraft operators will be phased out in 2026, exposing them to the full price of carbon. When that happens, there will be a sharper incentive to find reductions. This effect can be seen clearly in the wider EU ETS, where electricity generators receive no free allowances, resulting in a significant financial incentive to cut carbon.

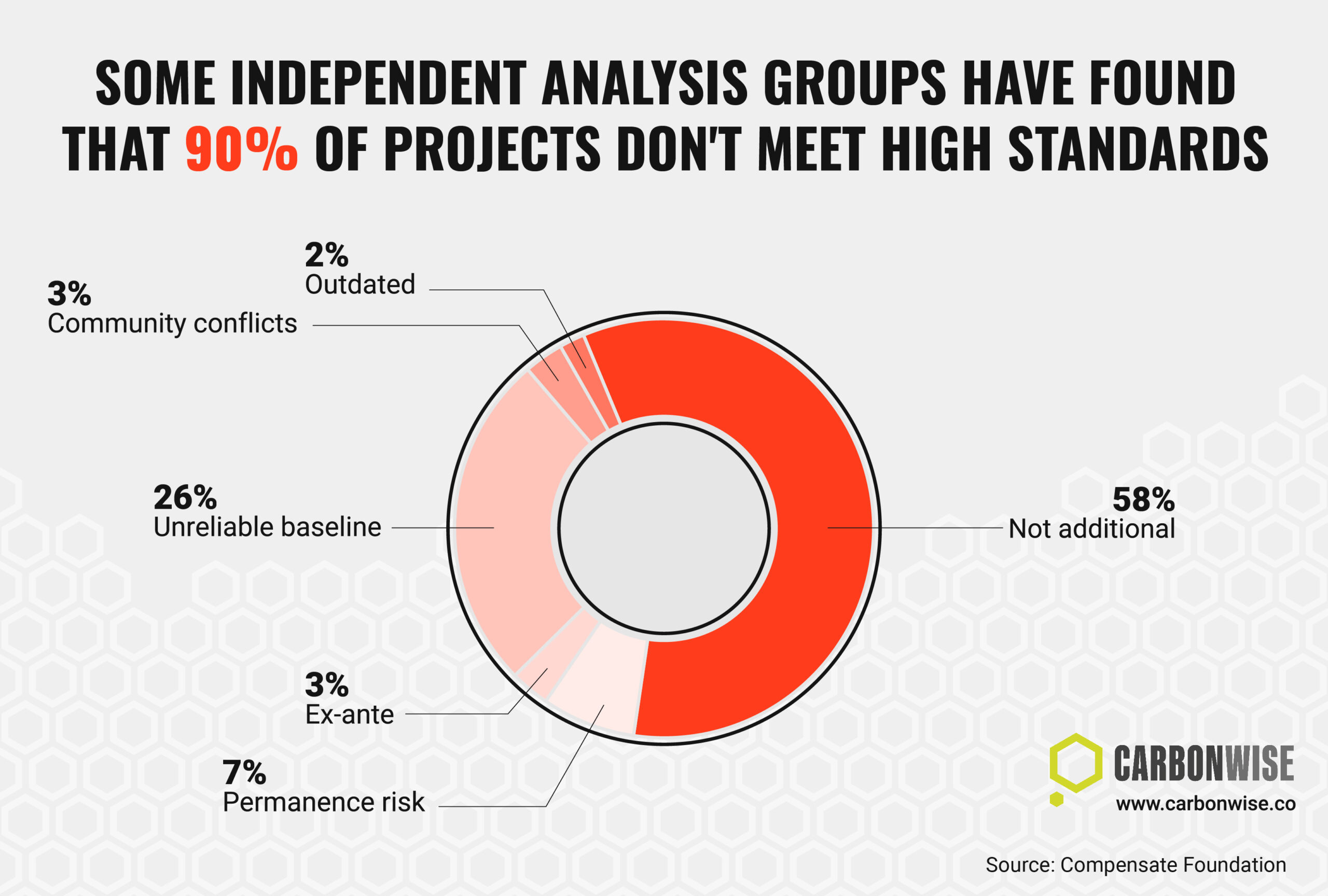

Meanwhile, in the voluntary carbon markets, further advancements were made in June on the Integrity Council for the Voluntary Carbon Market’s Core Carbon Principles label for carbon credits.

The CCPs were established to help improve the integrity in the voluntary carbon markets by setting a global benchmark for quality. CCP-labelled carbon credits aim to make it easier for buyers to ensure they are investing in credits from projects that generate a meaningful contribution to greenhouse gas reductions or removals, while supporting sustainable development goals.

Independent governance group, the ICVCM, has invited all environmental exchanges and platforms intending to list contracts referencing the ICVCM CCP-labelled carbon credits to contact them to agree on commercial terms relating to these contracts.

This is a sign that the ongoing governance work to improve environmental integrity in the VCM is moving from the drawing board into the real world, with decisions on quality set to show up in the traded markets soon. Greater confidence brings increased investment, and it is reasonable to expect to see interest building in these markets over the long term as this important work continues.