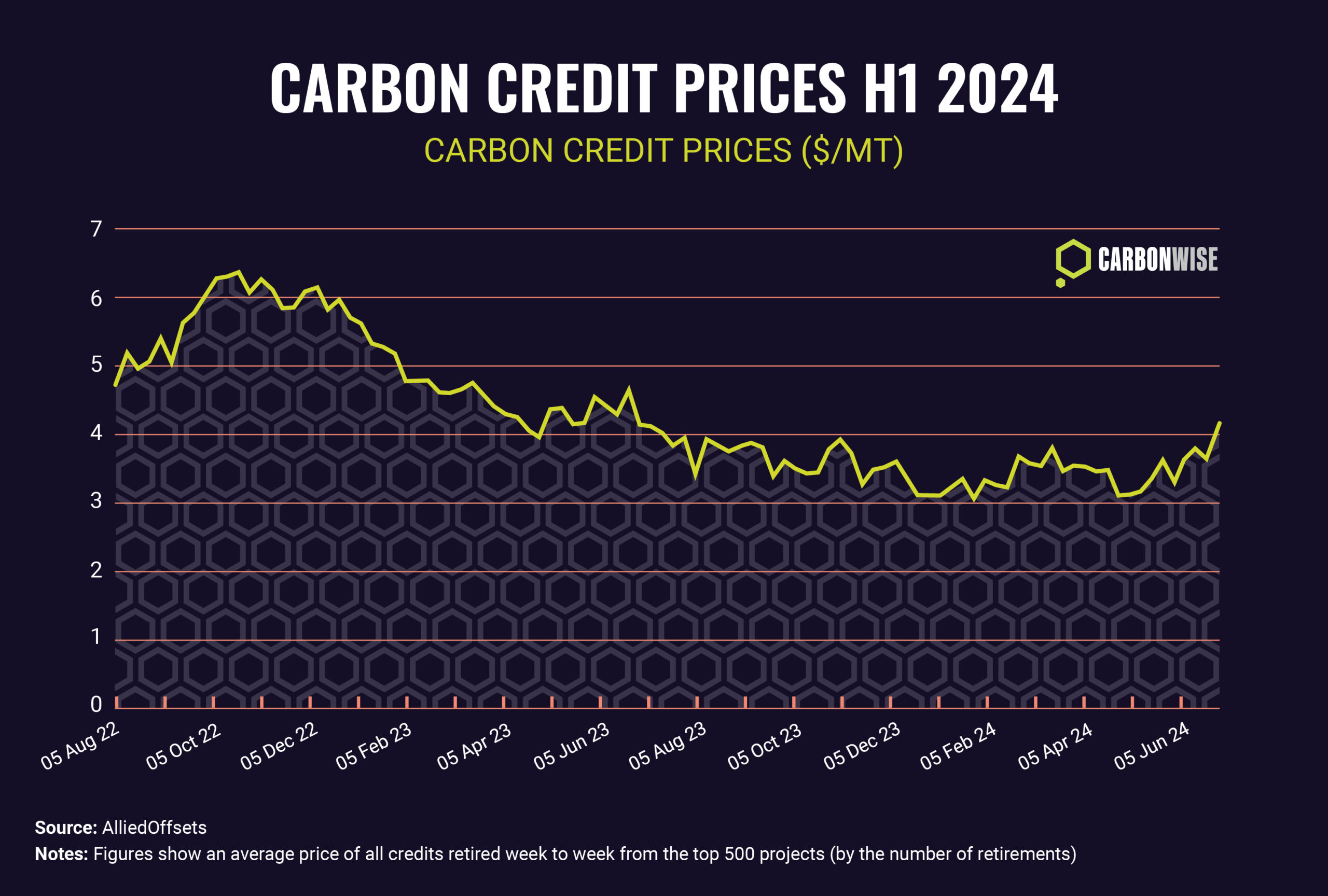

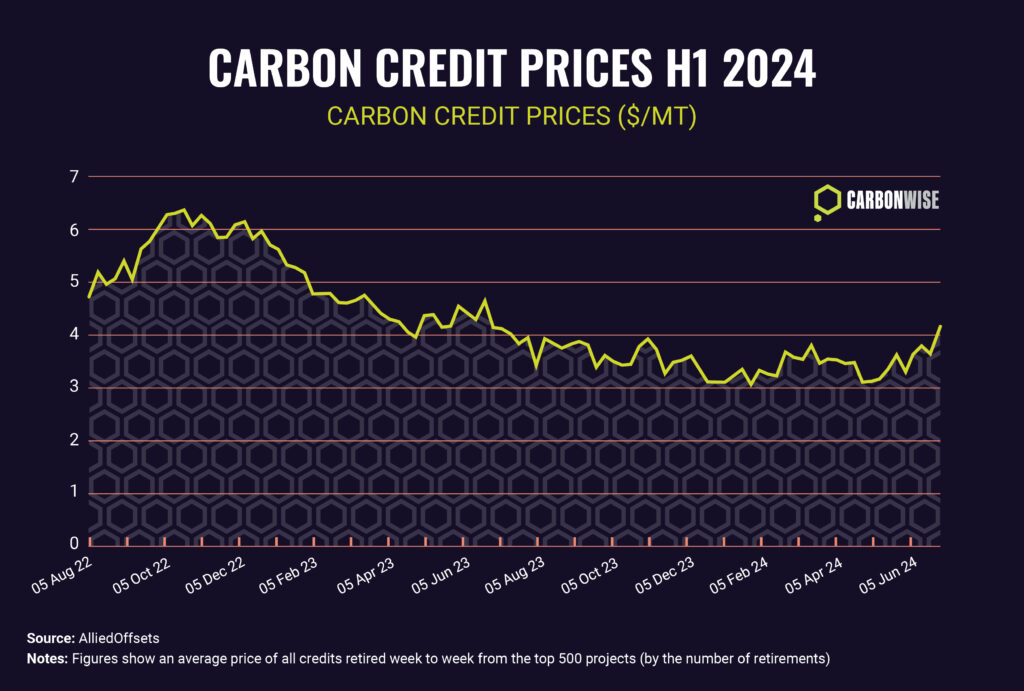

Average carbon credit prices in the voluntary carbon markets have shown signs of stabilising in the first half of 2024, after a clear downward trend that persisted through 2023, data from information provider AlliedOffsets shows.

Higher interest rates had a slowing effect on industrial activity in general in 2023, but with looser monetary policy looming before the end of 2024, this could herald a more positive environment for investors.

In addition, a string of critical stories in the media in 2023 highlighted shortcomings in regard to certain carbon credit projects, which harmed the reputation of the voluntary carbon market and dented investor interest. Efforts are ongoing to improve the environmental integrity of carbon credit projects, while at the same time, companies and other organisations continue to come under increasing pressure to align with science-based climate targets, net zero emissions goals for 2050 or to set more general corporate sustainability goals that may involve the purchase and retirement of carbon credits.

A report in October 2023 also found that companies buying carbon credits are more likely to be reducing their own direct emissions compared with those who are not involved in the market, suggesting that accusations of corporate greenwashing in the carbon markets are not well founded.

Added to this, compliance credit markets such as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) are also driving demand for carbon credits as airlines are required to use credits to offset any emissions growth above a 2019 baseline. This is likely to materialise as aviation’s emissions continue to recover from 2020 to 2021 when government lockdowns severely curtailed flights worldwide.

Taken together, these factors suggest demand for carbon credits is building, and that prices have the potential to rise if companies continue to deliver on their climate commitments and efforts to improve environmental integrity in the VCM are effective.