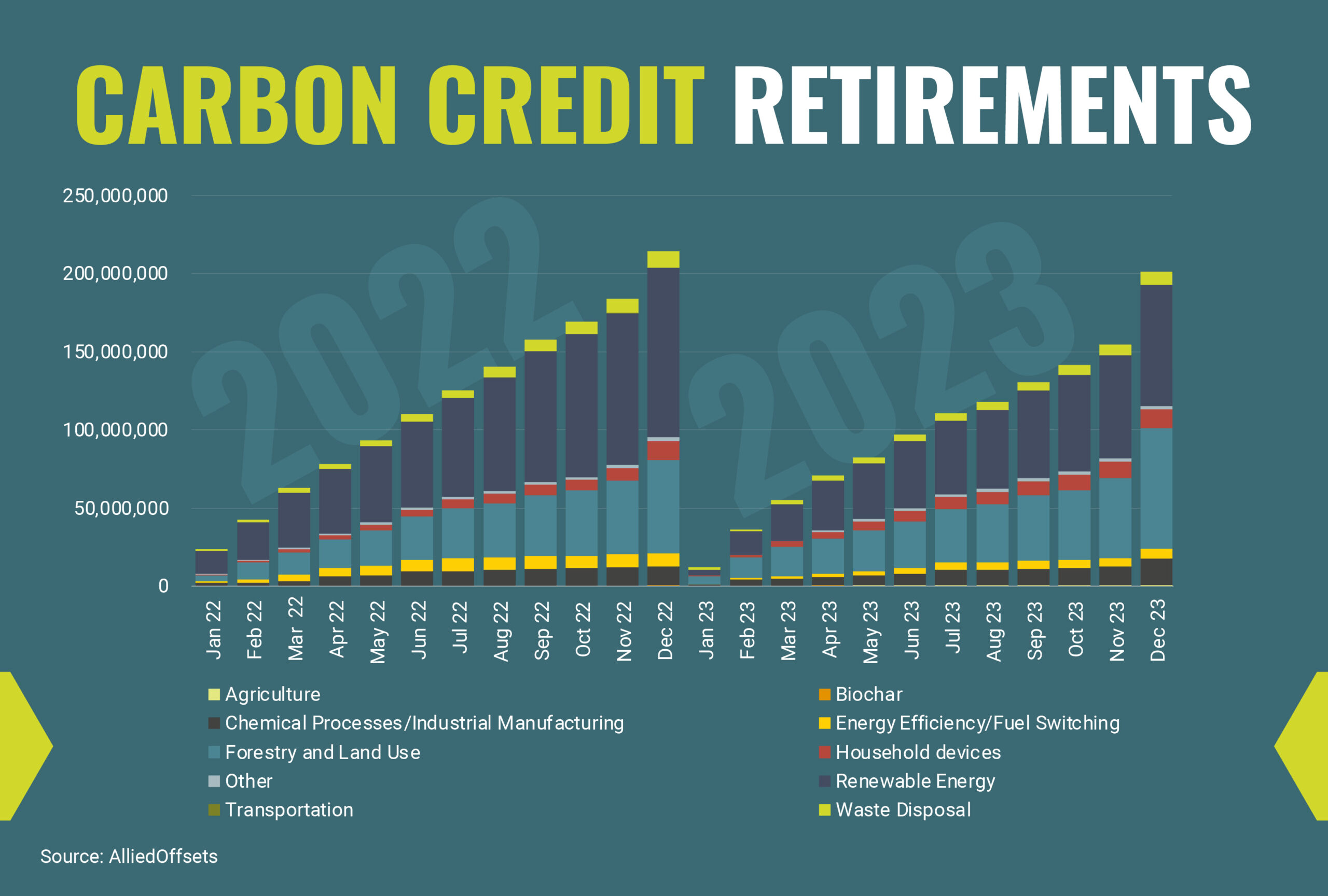

Global carbon credit retirements fell by 10.9% in 2023 compared with the previous year, according to data from AlliedOffsets – a major data source for carbon credits.

The company’s figures show that total retirements of credits fell to 200.9 million tons of CO2 equivalent in 2023, compared with 225.5 million tons CO2e in 2022. That’s a drop of just under 24.7 million tons CO2e or 10.9%.

Retirements refer to carbon credits being removed from emissions registries and permanently deleted, meaning they cannot be sold or used again.

The figures cover credits from ten broad project types: agriculture, biochar, chemical processes/industrial manufacturing, energy efficiency/fuel switching, forestry and land use, household devices, renewable energy, transportation and waste disposal and ‘other’.

The year-on-year drop in credit retirements showed up particularly clearly in two of the dominant project types – namely renewable energy and forestry and land use.

The drop in retirement of credits indicates a general cooling off in interest in the use of carbon credits in 2023, which has been partly driven by negative media coverage which is focused on a few projects where environmental integrity has come into question.

Nevertheless, the dip in retirements seen in 2023 may end up being short-lived.

To be sure, the business environment in 2023 has been challenging and the drop in credit retirement rates reflects this. Interest rates surged in 2022 and 2023 in most major economies, raising the cost of borrowing and having a cooling effect on companies and industrial activity in general.

However, the signs are generally positive for greater use of carbon credits over the long term. The global goal to reduce greenhouse gas emissions to net-zero by 2050 has not gone away, and an increasing number of companies are setting targets to reduce and offset emissions.

Countries are signing up to more stringent national targets under the Paris Agreement, and a review process that runs in five-year cycles is expected to ramp up national environmental ambition over time. To aid this process, the United Nations is working on rules that will allow the use of carbon credits to help meet national climate targets, and new markets are springing up around the world that require companies to surrender carbon credits, driving increased demand over the long term.