Voluntary carbon offsets and legally binding carbon compliance markets both involve putting a price tag on greenhouse gas (GHG) emissions, driving companies to consider their carbon footprint as a financial liability. However, the two markets are completely different in almost every other way, with different structures, purposes, regulatory environments, participants, prices and outcomes.

So what are the key differences between these important environmental instruments?

Regulatory structures

Most importantly, their regulatory structures are totally different. In the market for voluntary carbon offsetting, there is no legislation underpinning the markets. Rather, they have come about from the bottom-up, through cooperation between corporate emitters of GHGs and non-governmental bodies that have created the standards underpinning the emissions reduction projects that earn credits.

By contrast, the carbon compliance markets, known as emissions cap-and-trade systems, are created in a top-down approach by local, national or regional governments. Unlike the voluntary market for carbon offsets, the compliance markets are legally binding on companies in regulated sectors and often include a financial penalty for non-compliance.

Different goals

Fundamentally, the markets have different goals.

The voluntary carbon market seeks to provide tradable credits that allow companies to offset their GHG emissions, facilitating their journey to net zero emissions. Companies are encouraged to reduce their own emissions wherever possible, and then to offset any remaining unavoidable emissions, by investing in emissions reduction or removal projects elsewhere.

Meanwhile, the compliance markets seek to drive actual and quantifiable reductions in emissions from regulated entities over an agreed timeframe in a flexible and affordable way, harnessing market forces to incentivise the lowest-cost reductions first.

Fixed vs unlimited supply

Another critical difference between carbon offsetting and compliance markets is supply.

Under the compliance markets, total emissions from regulated companies are capped on an annual basis, and this ‘cap’ shrinks each year, reducing the supply of allowances over time. This forces companies to find ways to cut emissions or buy surplus allowances from someone else within the system.

Meanwhile, in the voluntary carbon market, there is no such cap on total supply. Project developers are free to create new emissions reduction or removal projects that add to the total supply of offset credits in the system, limited only by the availability of land and feasibility of new projects within the approved project types.

Participants

The markets also attract different participants, albeit with some overlap between the two.

Participants in the carbon compliance markets tend to be companies in sectors covered by the legislation. Most emissions trading systems so far have regulated CO2 emissions from electricity generation, as the sector with typically the largest carbon footprint. Many markets have also included CO2 emissions from heavy industries such as metals, chemicals and cement production, aviation, shipping and others.

Importantly, the compliance markets also involve financial intermediaries such as banks, specialist trading houses, commodity brokers and hedge funds, who act as ‘market makers’. They are not significant emitters of GHGs but they are active in the market to make a profit, or to hedge their own risk, in some cases as part of a widely diverse portfolio of investments.

Their role is to provide price transparency and liquidity, that is, to ensure that there is always an available supply of allowances to buy or to sell.

In the voluntary carbon markets, any company with a carbon footprint can participate, if they have the desire and capability to invest in offset credits. This market too involves players from the financial markets.

Reasons for participating

In compliance markets, CO2-emitting companies participate because they are legally obliged to do so, and face heavy financial penalties for non-compliance. The financial players participate in order to make a profit, or to manage risks linked to a wide range of investments.

In the voluntary carbon markets, emitting entities can choose to participate if they want to make credible claims about their environmental sustainability, including for example, demonstrating progress toward achieving voluntary net-zero emissions targets. Some companies may also want to demonstrate progress on wider environmental, social or governance issues through the purchase of offset credits.

Outcomes

Carbon compliance markets seek to deliver a pre-agreed reduction in total GHG emissions over a timeframe agreed in the legislation, and at lowest overall cost to the economy. The outcome can be judged through publicly available data showing an overall reduction in GHG emissions from the sectors covered by the system, coupled with economic data for the period in question.

For example, the EU’s Emissions Trading System has seen CO2 emissions from more than 11,000 individual power plants and factories fall from more than 1.8 billion tonnes in 2008 to as little as 1.2 billion tonnes in 2020.

Voluntary carbon markets on the other hand, seek to avoid adding further to global emissions by offsetting a company’s emissions with reductions or removals achieved somewhere else. The outcome can be judged by independently verified data from the projects on the ground, showing that their objectives have been delivered.

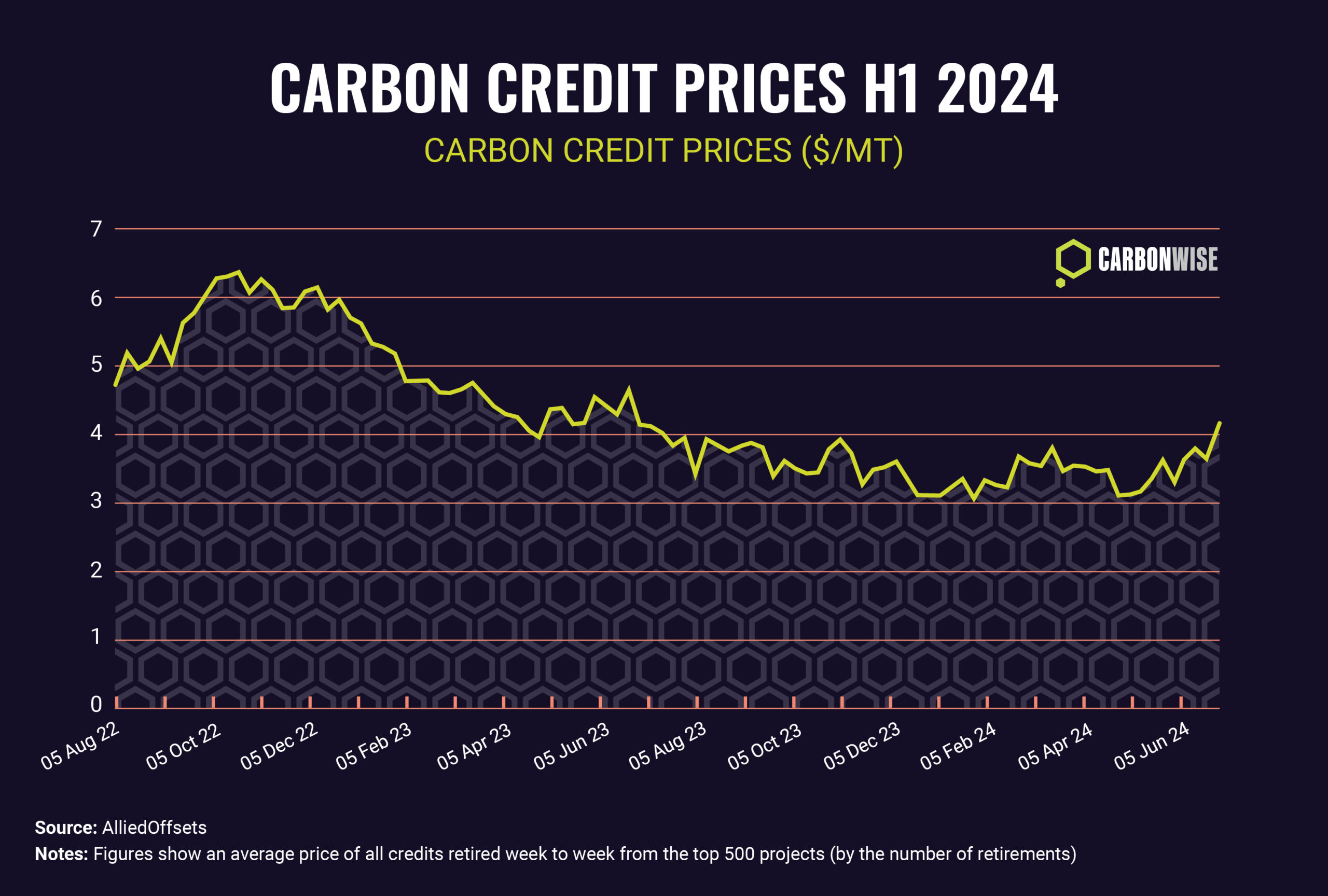

Prices

The price of carbon allowances has generally been higher than for voluntary offset credits, with some exceptions, because of the hard cap on supply. This means covered entities compete over a shrinking supply of allowances over time, with the price supported by the growing scarcity of permits.

On the other hand, the price of voluntary carbon credits has tended to be much lower, again with some exceptions, because there is no hard cap on supply, meaning companies can more easily source volume to match their particular requirements.

However, carbon credits have traded in a very wide price range due to fundamental differences in their origin. Standard carbon credits have been seen trading as low as $1 per tonne, while credits from specialist technology-based carbon removal projects, for example, have traded above $200 per tonne. Other project types can also attract premiums because of the additional benefits delivered by some projects, for example, those that boost biodiversity or contribute to improved living standards.