The term ‘carbon market’ is tossed around very casually these days, and it can be very misleading when you’re referring to the EU Emissions Trading System, but someone else is thinking of the global aviation sector’s market, CORSIA.

To be sure, both are markets in which there are buyers and sellers of carbon instruments, and in which the overall goal is to reduce greenhouse gas emissions, but the similarities more or less end there.

Clarifying those distinctions and bringing greater understanding of all the various kinds of carbon market is what Carbonwise is all about.

So let’s start by setting out the key terms that people use. We suggest also reading about the differences between carbon allowances and carbon offsets.

1. Emissions Trading System (ETS) – also referred to as a compliance market or “cap-and-trade”

These markets are set down in law, and require covered entities to comply with an overall limit on greenhouse gas emissions. The “cap” represents the market-wide limit on greenhouse gases, and it’s expressed in the number of carbon allowances or permits that are issued by the regulator.

We’ve described cap-and-trade markets here.

Examples of emissions trading systems can be found in the European Union, California, New Zealand, South Korea and the United Kingdom.

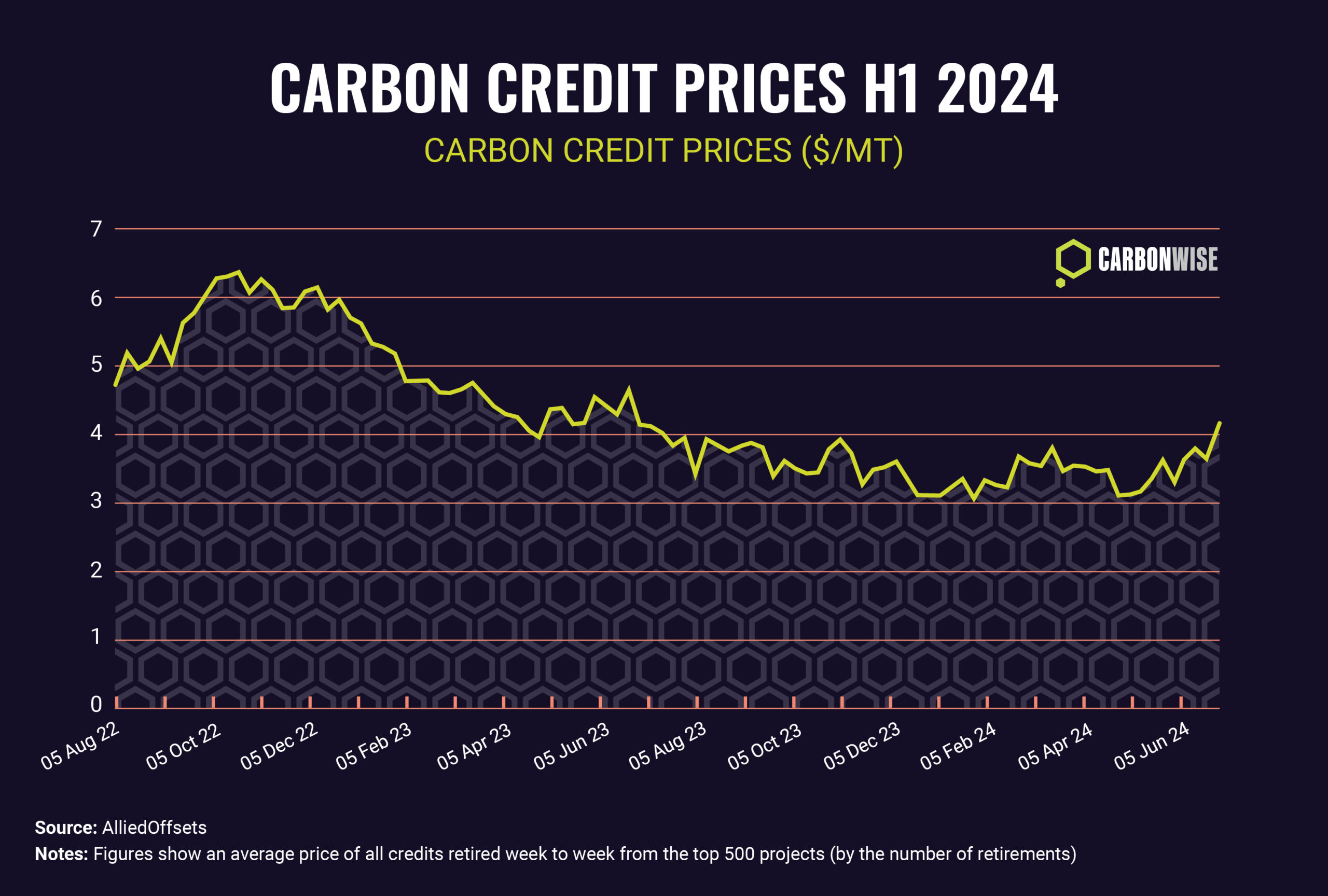

2. Voluntary Carbon Market – sometimes referred to in the plural, and often abbreviated as VCM

This term, while it’s often used, doesn’t refer to a single marketplace or system. Instead, ‘VCM” refers to the general trade in carbon credits which are used to voluntarily offset corporate carbon footprints.

The voluntary market isn’t regulated in law as ETSs are but instead, private sector participants have banded together in initiatives to self-regulate the creation and use of carbon credits.

3. Compliance Offset Markets

We offer this term as a way to describe those mandatory markets in which carbon credits are the only instrument of compliance.

These markets are established by a legal authority, be it a national or regional jurisdiction or an industry regulator. They require covered entities to buy and retire carbon credits matching their emissions.

The prime example of a compliance offset market is CORSIA, the International Civil Aviation Organisation’s global market for air transport.

Some emissions trading systems (like California and South Korea) allow the use of a limited amount of strictly defined carbon credits for compliance, in order to moderate prices.

4. Carbon Taxes

Some national carbon taxes are payable in carbon offsets. Colombia and South Africa, for example, allow companies to buy and surrender specified types of carbon credits instead of making a financial payment.